Business Tax Incentives

PUT FEDERAL TAX DEDUCTIONS AND CREDIT TO WORK FOR YOU

BUY A NEW GMC AND SAVE BIG!

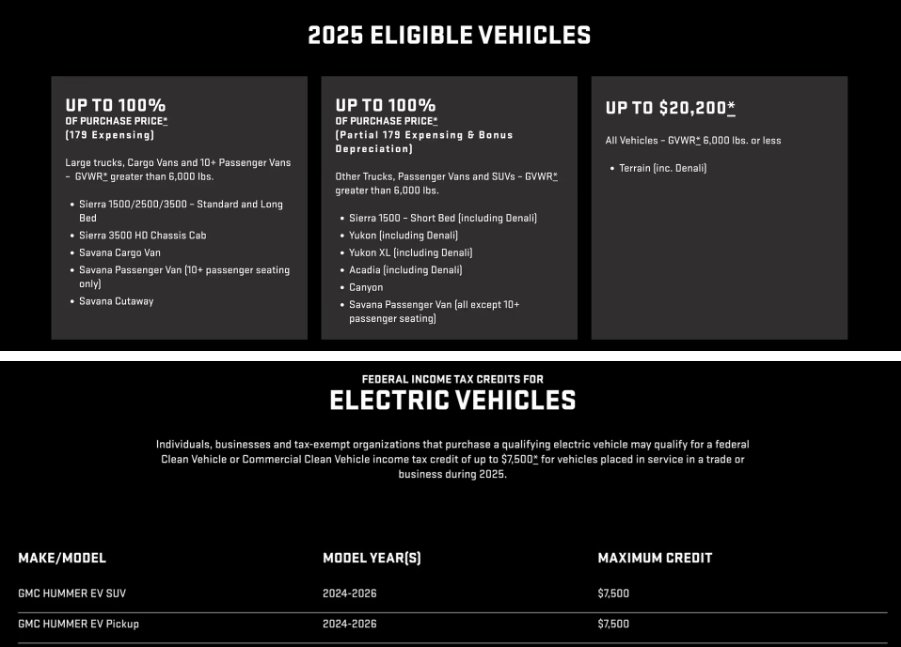

You could get more tax benefits when you purchase the vehicles that you need. Both large and small businesses may be eligible to immediately deduct up to 100% of the purchase price of qualifying vehicles. Beginning in 2024, businesses that purchase qualifying electric vehicles in the 2025 tax year may qualify for a federal income tax credit of up to $7,500.

How Section 179 Works:

Thanks to the guidelines under the IRS 179 tax code you can earn a substantial tax deduction when you purchase, finance or lease any qualifying vehicle. The tax benefits provided under IRS section 179, allows many small businesses to write off the entire purchase cost of one or more qualifying new GMC trucks or vans.

NOW IS A GREAT TIME TO BUY!

Save with the tax savings opportunities above, or take advantage of our other available GMC offers.

Shop Inventory| Monday | 8:00AM - 6:30PM |

| Tuesday | 8:00AM - 6:30PM |

| Wednesday | 8:00AM - 6:30PM |

| Thursday | 8:00AM - 6:30PM |

| Friday | 8:00AM - 6:00PM |

| Saturday | 9:00AM - 5:00PM |

| Sunday | 10:30AM - 4:00PM |

| Monday | 7:30AM - 5:00PM |

| Tuesday | 7:30AM - 5:00PM |

| Wednesday | 7:30AM - 5:00PM |

| Thursday | 7:30AM - 5:00PM |

| Friday | 7:30AM - 5:00PM |

| Saturday | Closed |

| Sunday | Closed |

| Monday | 7:30AM - 5:00PM |

| Tuesday | 7:30AM - 5:00PM |

| Wednesday | 7:30AM - 5:00PM |

| Thursday | 7:30AM - 5:00PM |

| Friday | 7:30AM - 5:00PM |

| Saturday | Closed |

| Sunday | Closed |